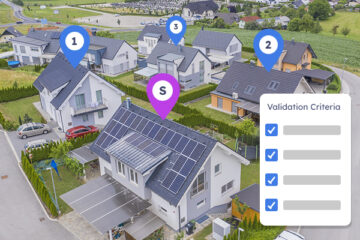

There are many steps in the process of reviewing appraisals and our focus in this series of articles is the comparable analysis step to validate the sales comparison approach. This is the second article which is going to delve into the validation of comparable adjustments. Please check out the earlier article on validating the selection of comparables.

If we have verified that the comparable selection is sound, the next step is to make sure the appropriate adjustments are applied to the comparables to appropriately account for the variations of the comparable from the subject. This is further broken down into 2 steps:

- Validate the raw data captured for each comparable property

- Validate the feature level unit adjustments applied to each comparable property

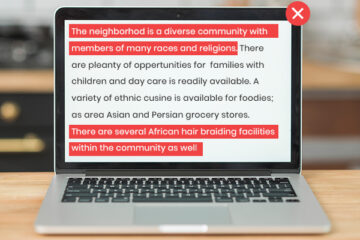

Validate comparable data using MLS, Public Records, & Photos

This type of validation can be accomplished by comparing it to other verifiable or authoritative sources of property data. The most common data sources are the MLS or the public record data from the county assessor’s office. Appraisers usually have a membership at the MLS and search the county records to get this information. On the other hand reviewers resort to looking up the property on public real estate websites such as Zillow or Realtor.com and search the county records as well.

A comprehensive appraisal review software can simplify this step by automatically matching the comparable data to MLS and assessor records and highlighting any discrepancies that require attention.

AI Models extract data from Property Photos

In addition to validating against the data provided by the MLS and public records, a third data source is making its way into appraisal software powered by deep learning and computer vision technologies. Appraisal review software providers with access to property images for both the subject and comparable properties can now extract useful property characteristic information and use that to validate the appraiser’s data capture.

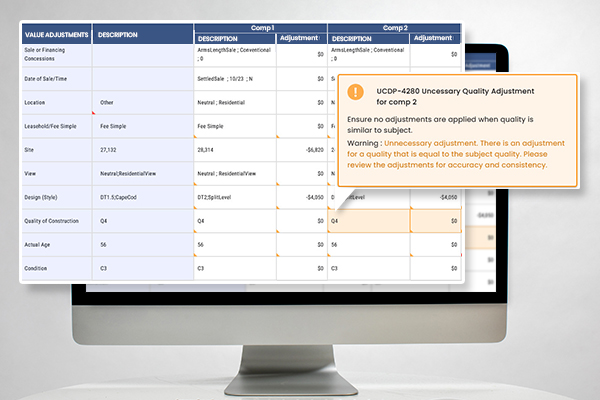

Validate feature specific unit adjustments

This step requires a little bit of math to ensure the adjustments are accurate and consistent across all the comparable properties. Below are the scenarios to consider in validating the adjustments.

Missing Adjustments

Every time a comparable property feature is different from the subject property, we would expect compensation for that variance. If the subject property has 5 bedrooms and the comparable has 4 bedrooms we would expect to see an adjustment for the value of 1 bedroom. Or if the subject’s living area is 2,000 sq ft and the comparable property’s living area is 2,100 sq ft we may expect an adjustment for the 100 sq ft of living area. In some cases, small variations in values may not contribute to a change in value and so it may be permissible to not adjust the comparable for it. For example, if the lot size of the subject is 14,300 sq ft and the comparable is 14,100 sq ft it may not make a difference in the value of the property. So, differences within a variance threshold need not be adjusted for value and as such should not be flagged as errors.

Appraisal software would provide customizable rules to support such scenarios based on property type, location of the property (urban, suburban, vs. rural), and the contributory effects of certain property characteristics to the overall value.

Direction of the Adjustment

This is the simplest of all the adjustment validations. All it tries to achieve is to ensure that if the comparable is inferior to the subject for a specific characteristic, the adjustment amount must be positive and if the comparable is superior to the subject for a specific characteristic, the adjustment amount must be negative. It naturally follows the theory that for a comparable to match the subject we need to increase the value of the comparable if it is inferior to the subject and vice versa.

Validate the consistency of adjustments across comparable properties

This is best explained with an example. Consider that the subject’s living area is 2,000 sf and 2 comparable properties have the following living area values and adjustments:

- Comparable A has a living area of 1,900 sf

- Comparable B has a living area of 1,800 sf

Further consider that the appraiser applied an adjustment of $20,000 for A and $30,000 for B. This implies that for A the price per sq ft used was $2,000 / 100 = $200. On the other hand the price per sq ft used for B was $30,000 / 200 = $150. Since the unit adjustment for A and B are different the appraiser would have to justify such differences in their notes. We could also define a rule that if unit adjustments differ by more than a threshold – say 10%, the relevant comparable properties and features are flagged for a potential issue.

Ensure that the unit adjustments applied are accurate

In other words, if the appraiser used $10,000 as the unit adjustment for a bedroom we need to validate if that number is in fact true for the subject’s market.

One way to achieve that is by calculating the value range for one bedroom in the subject’s neighborhood and for the subject’s property type using all the recent sale data available. Determining the correct value range for a bedroom is not easily done unless there is access to large amounts of data. Fannie Mae’s Collateral Underwriter (CU) provides such feedback in its Submission Summary Reports (SSRs). But we should also expect appraisal review software to provide similar insights on unit adjustments to catch such anomalies long before they are submitted to the GSEs.

Other Adjustment Validations

While these type adjustment validations are useful for quantitative property characteristics, it cannot be easily applied to certain qualitative features such as a deck or a pool. A pool adjustment for 2 comparables can be different because such adjustments are dependent on the size of the pool. It is important to note that such adjustment variations would not differ based on the condition or quality of construction of the features because they must be captured as part of the condition and quality adjustments.

Key Takeaways

Performing the adjustment validations presented here is a time consuming and error prone process for a review or chief appraiser. Most appraisal review software platforms do not have access to market data on comparable sales. As a result they develop rules to only cover the following scenarios:

- Look for missing adjustments

- Validate the direction of the adjustment

- Validate the consistency of adjustments across comparable properties

A limited number of review platforms are powered by nationwide sale data combined with AI and machine learning models that can support the following additional validation criteria:

- Validate the comparable data using MLS, Public Record, and Photos

- Ensure unit adjustments used by the appraiser are accurate

When you are researching appraisal review software it is important to consider the above validation scenarios to find a platform that ensures high productivity, accuracy and completeness of the review.