The core foundation of the sales comparison approach to real estate appraisals is the quality of the comparables used and adjustments made to those comparables to arrive at a value for the subject property. In previous articles in this series we discussed two major topics – understanding the characteristic similarity of the comparable properties to the subject and ensuring the value adjustments for any variations are appropriately applied. But, while the comparable may be similar to the subject, the choice of certain comparable properties may indicate bias in the appraisal process. We will dig into these concerns further in this article.

Bias in Property Valuations

In recent years property valuation bias has gained much needed attention. Lenders and appraisal management companies are striving to discover and eliminate any potential bias in the appraisal before the value information is used in lending decisions which can determine if a family gets to purchase a home and build wealth for generations to come or rent a home that only results in an ongoing expense.

An appraiser’s report on the value of a property reflects their opinion of value which may be shaped by numerous factors including objective data and many subjective factors such as neighborhood, property condition, and so on. Lenders and AMCs need to consider various methods to detect any bias indicators in the valuation report and we will delve into each of them but here is a list. By no means must this be treated as a comprehensive checklist for bias detection, but should serve as a good starting point for bias reviews. In addition, the identification any one of these would not automatically imply bias, but should only be a trigger point for a holistic review.

- Appraiser Comments: Do any of the appraiser’s comments indicate potential bias?

- Photo Analysis: Do any of the photos included report contain people or symbols that may convey a bias? As you will see below, this is not helpful in traditional appraisals.

- Similar Comparables: Are the subject and comparable properties reported similar in characteristics, condition and quality of construction?

- Similar Neighborhoods: When comparable sales are selected from a different neighborhood due to lack of sales, is the comparable property’s neighborhood similar to the subject’s neighborhood in terms of demographics, economic conditions, and property value indicators

- Accurate Adjustments: Are the adjustments applied to comparables accurate and sufficiently compensate for the variations? For example, if the comparable’s condition is not similar to the subject, is the adjustment applied sufficient?

Appraiser Comments

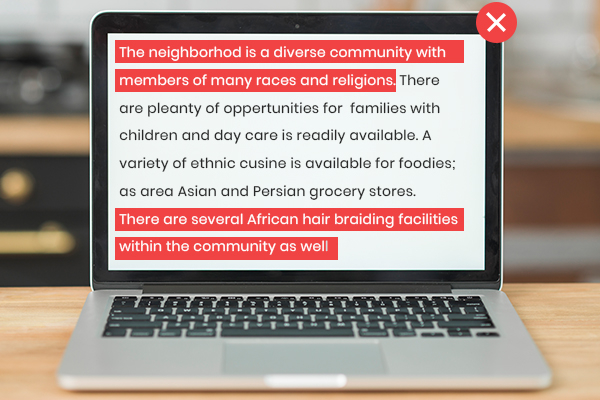

The most common approach to detect any potential bias in the comments entered by appraisers has been to find words and phrases such as “black neighborhood” or “neighborhood with Indian restaurants” or “owners are an older couple”, etc. Initial attempts at this were based on keyword searches which resulted in many false positives such as “chinese marble” or “white kitchen” etc. But now better solutions have been developed to use limited natural language processing to check if the words actually refer to a person or neighborhood. This avoids the false positives but any keyword based approach will continue to be a challenge to scale and better solutions need to be developed using Artificial Intelligence that will better understand the appraiser’s actual intent in a comment and also treat all the comments in the appraisal holistically to make a judgment of bias.

Photo Analysis

When the appraiser visits a property for an inspection it is common to run into various items within the house that may either consciously or subconsciously cause the appraiser to create valuation biases. The most common of such items are religious symbols, photos of the occupants, etc. Since the appraiser visited the property and has been exposed to the contents of the house, it is hard to remove any unconscious biases at the time of final value adjustments or reconciliation. The industry has been adopting the bifurcated appraisal or the hybrid appraisal wherein the inspection is conducted by a different person and only the photos collected from the inspection are available to an appraiser to complete their valuation report. A byproduct of this method is that it ensures that the appraisers are not exposed to any subjective information about the property as it relates to the profile of the occupants thereby reducing the risk of bias in the resulting valuation.

When the inspector in a bifurcated appraisal delivers the photos to the appraiser, they must ensure that the photos do not contain any information that may indicate the owner or occupant’s profile. Reviewers of bifurcated appraisals must flag such photos as indicators of bias. Technology comes to the rescue again to simplify such analysis using deep learning models that can detect objects in a photo and categorize them as bias indicators.

It is important to note that such photo analysis does not help with determining bias indicators in traditional appraisals because the photos are only a deliverable but the appraiser performing the valuation has already seen the contents of the property first hand.

Similar Comparables

In general, it is a standard practice and requirement that appraisers choose the most similar comparables to the subject and not doing so does not automatically indicate bias. In certain markets due to limited volume of sales within the neighborhood the appraiser may be forced to choose certain comparables that are not too similar to the subject. While that is justified, it could be a bias flag if such a dissimilar comparable selection is made within neighborhoods that have a reasonable number of recent comparable sales.

Let us also consider similarity by condition and quality. Within a neighborhood the condition of properties may vary due to long term maintenance and upkeep. In addition, depending on how a neighborhood evolved over the years the properties may also differ in their quality of construction. For example subdivisions developed by a single large builder would have properties with a homogenous construction quality while other neighborhoods with homes built by different custom builders would have a large variation in construction quality. The choice of a comparable of poor or better condition or quality compare to the subject without a sufficient adjustment could indicate an under- or overvaluation.

Appraisal review solutions powered by large data sets can use machine learning models to figure out the similarity of the comparables to the subject and if it is determined that the selected comparables are not the best possible, the solution would be able to indicate a potential bias.

Similar Neighborhoods

Most times appraisers do choose comparable properties from the same neighborhood as the subject. But in cases where the subject’s neighborhood has a limited number of recent sales or if the neighborhood is too heterogenous to find similar properties, appraisers will have to find comparable properties from other neighboring markets. Even though the comparable may be similar to the subject in terms of all the characteristics such as bedrooms, bathrooms, living area, etc. it may not be a valid comparable if the comparable property’s neighborhood is different than that of the subject’s. Consider a case where the subject is located within a historic district of a town and the comparable is outside the historic district just a few streets over.

Selection of comps from non-similar neighborhoods could indicate bias as in this example: Subject is in a predominantly white neighborhood, but a comparable is from a predominantly black neighborhood.

When choosing comparables from outside the subject’s neighborhood the appraiser has to find a neighborhood that is similar to the subject’s in addition to finding a similar property.

Neighborhood similarity may be determined based on many factors such as:

- Builder or developer of the neighborhood – keeping in mind that the same builder could construct different qualities of properties.

- Zoning mix – ratio of land use between residential, commercial, industrial, farms, etc.

- Demographics – race, ethnicity, age, marital status, occupancy, household size, etc.

- Economics – employment rates, income levels, etc.

- Others – crime rates, flooding risk, etc.

Another important factor to consider would be property values within the neighborhoods. For example, median price per sq ft or media sale prices for specific property types in the neighborhoods. This may cause some discomfort to say the least for the purist appraiser in us, but it should be considered as a flag that needs further investigation and as opposed to a direct evidence of bias.

Accurate Adjustments

When comparable properties vary from the subject, which is always the case, the appraiser is required to make the necessary adjustments to the comparable values to compensate for those variations. This is a very important step in the appraisal process and could sway the final opinion of value if the adjustments are not done correctly.

So, what has this got to do with bias? Let us take an example to discuss this. Consider 2 appraisals for properties in the same neighborhood and with similar quality of construction and similar gross living area. Further consider that one property is owned by a black family and the other is owned by a white family. If the average condition adjustment in one appraisal is far greater than the average condition adjustment in the other, it may indicate that the value of the property with the greater adjustment has been boosted for other non-objective reasons.

As we discussed in a previous article (see here), using large scale data and machine learning models can compute expected adjustment ranges in specific neighborhoods and property types and the appraiser entered adjustments can be validated. Fannie Mae’s Collateral Underwriter does provide such model driven adjustment ranges and so do a few appraisal review platforms powered by similar models. But it is important to note that such models cannot account for historic biases already built into market valuations due to redlining by lenders in the past.

Key Takeaway

Appraisers, Lenders and AMCs need to be aware and follow a few rules that can ensure objectivity in property valuations. Software solutions that can detect and flag potential bias during the valuation and/or review process can improve the quality of appraisals and the trust in the valuation process.

When choosing an appraisal review platform, lenders and AMCs should look for the emerging technologies that consider all the factors discussed in this article and also a platform that can evolve to meet future bias detection needs.