Profet Review Solutions

Learn how Profet Review is helping AMCs and Lenders

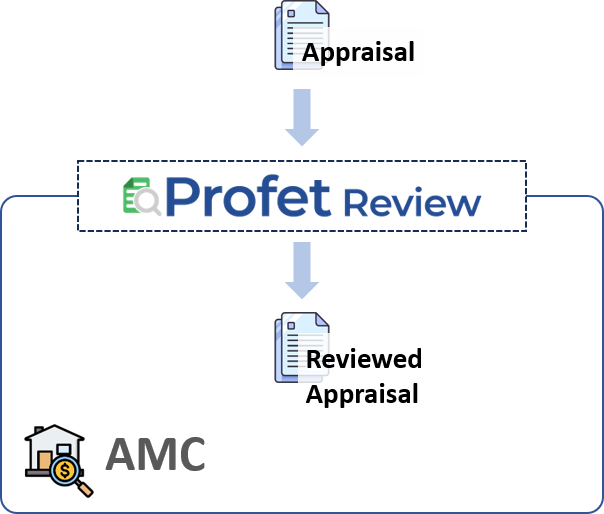

Edge Review

Review the appraisal before it enters your door

AMCs and Lenders would like to save time and effort flagging basic hard stops that could have been easily fixed by the appraiser before submitting the appraisal. In addition, with new requirements on language bias checks, we need automation to catch such errors early in the process.

Profet’s Edge Review does exactly that for you.

With Edge Review, a core rule set covering hard stops, bias, or compliance can be configured to be executed for each appraisal before being submitted to the AMC. Appraiser’s can check their appraisals within Profet Edge Review and include a “review pass certificate” along with their submissions.

AMC internal reviewers can apply additional criteria – such as property complexity, historic property, property value, and so on to determine if the valuation requires a deeper review.

Profet Review, powered by a huge data lake and AI that analyzes language, photos, and floor plans can be easily customized for your specific Edge Review needs.

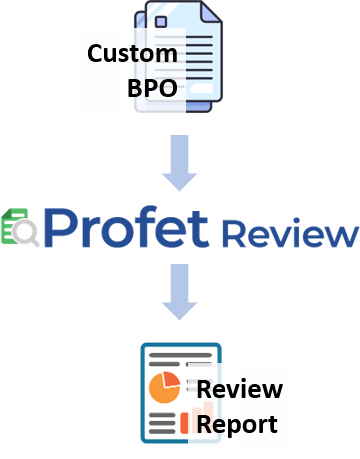

QC for BPOs

Profet Review can be customized to review your branded valuation products

Profet Review has the unique capability to run all its capabilities – rules, photo analysis, floor plan analysis, and bias detection on any valuation product.

SWBC, a leading provider of valuation services, is now able to validate their Broker Price Opinions (BPOs) before delivering to clients.

Profet Review consumes the custom BPO from SWBC and is able to seamlessly extract all the valuation information from the BPO and review it for accuracy and consistency and provide a quality score and a review report.

SWBC is able to manage all their QC capabilities and rules for both their alternate valuation products and GSE valuations such as 1004s, 10073s, etc. on a single platform.

Bias & Compliance

Provide proof of bias and compliance reviews to clients

The GSEs are demanding that Bias Language and Compliance reviews are completed before lenders submit the appraisals.

AMCs and appraisers can help lenders optimize their time & effort in reviewing by providing their a proof of a compliant appraisal.

Profet Review can be customized for running a subset of the rules including bias and photo compliance checks.

A custom review report is then produced for the AMC or appraiser to attach to their submission to the client.